FEATURED INSIGHTS

FEATURED INSIGHTS

How Much Electricity Does Traditional Banking Consume?

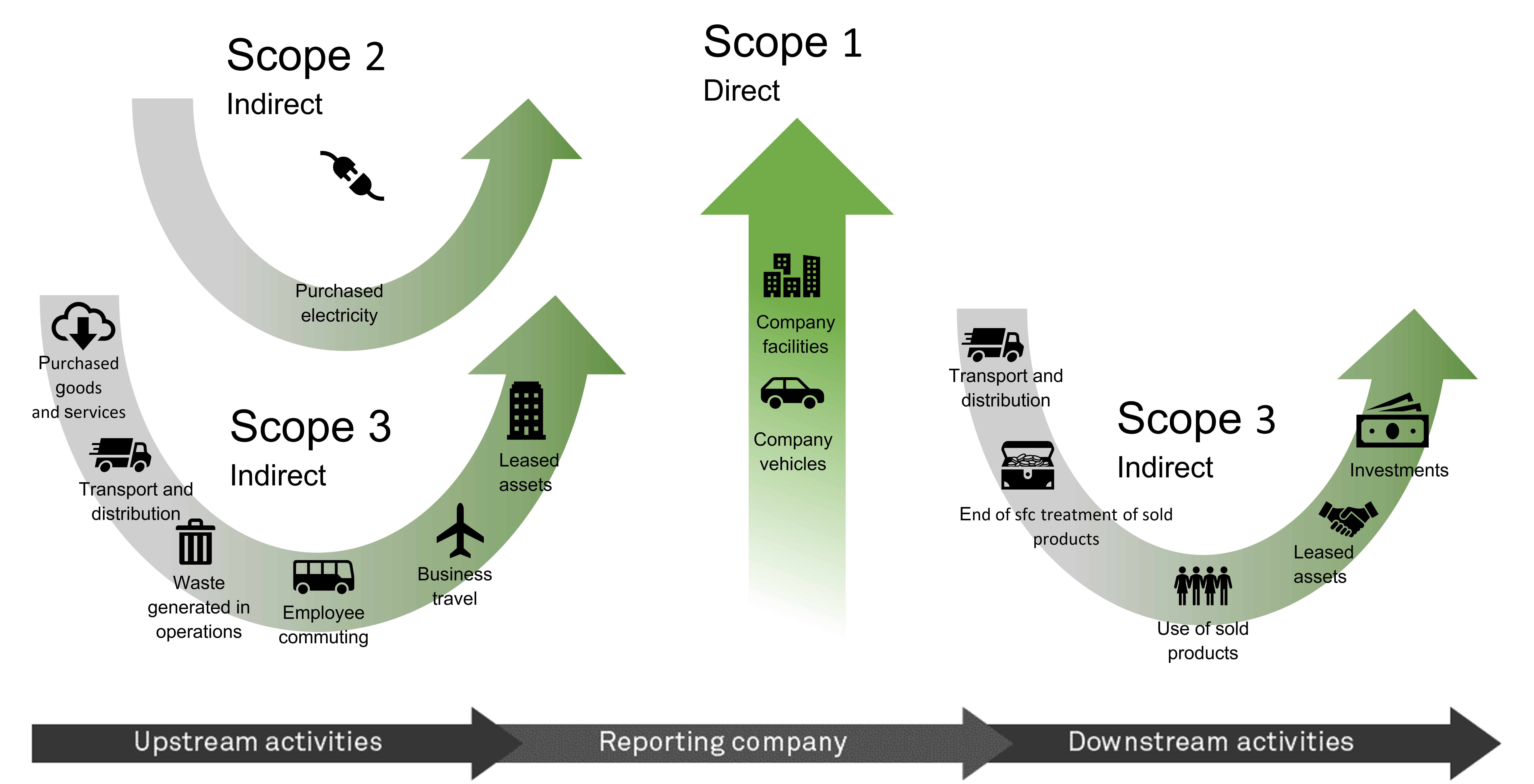

The financial sector aims to reduce its emissions through sustainability efforts and provide financing for renewable energy and energy efficiency projects. Since banks are connected to all sectors, sustainability is becoming increasingly important in the finance sector. As a part of their sustainability efforts, banks calculate their carbon footprints from scope 1 direct emissions, scope 2 indirect energy consumption, and scope 3 emissions from the supply chain.

The example of a bank's GHG (greenhouse gas) reporting is shown in Figure 1. Accordingly;

Figure 1: Scope 1,2,3 Emissions [1]

Scope 1 emissions are direct greenhouse gas emissions from facilities, branches, and headquarters owned or controlled by a financial institution. Natural gas use in offices and fuel consumption of corporate vehicles are also considered within scope 1. When the sustainability reports of banks were reviewed, it is seen that scope 1 emissions constitute 35-60% of the total carbon footprint. The wide variation is primarily due to the differences in the size of the bank's data center, the number of branches, and the number of employees.

Scope 2 emissions are indirect greenhouse gas emissions resulting from purchased electricity, heat, or steam production by a financial institution. In the finance sector, data centers consume electricity, especially for 24/7 online banking services. Electricity consumption represents 20-60% of the total carbon footprint.

Scope 3 emissions are indirect greenhouse gas emissions resulting from the activities of a financial institution. In traditional financial institutions, business travel, employee transportation, paper usage, materials, and services purchased by the institution are primarily reported within scope 3. Scope 3 emissions constitute an average of 10-20% of the total carbon footprint.

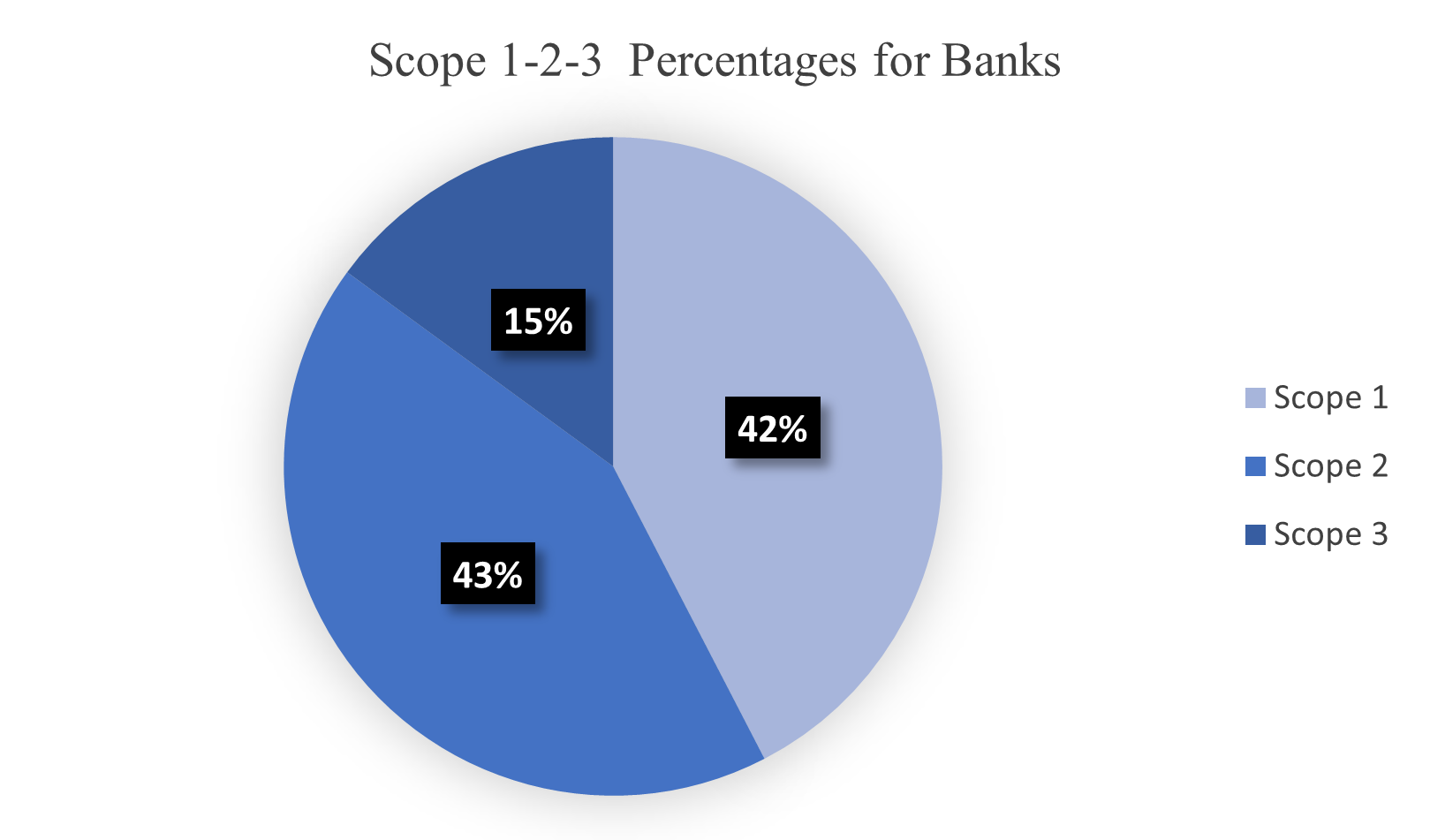

By examining the sustainability reports [2] of four different banks operating in Türkiye, the average percentages of scope 1, scope 2, and scope 3 values were calculated and shown in the graph below.

Figure 2: Scope 1,2,3 Emissions for Banks [2].

Within the scope of sustainable finance, project loans and fund investments provided by institutions are also reported within the scope 3. Therefore, the percentages which is given above may vary greatly within the scope of sustainable finance. You can review the 55th page of the 2022 sustainability report of ING Bank, which is based in the Netherlands, as an example of sustainable banking reporting [3].

In this article, Foton ECO will share its analyses regarding electricity consumption within scope 2, as a labeling program that ensures 100% renewable energy consumption.

When it comes to banks' electricity consumption, usually headquarters and branches come to mind; however, data centers and payment methods also have a high percentage of electricity consumption. All data in the banking infrastructure is processed in data centers that operate 24/7. Data centers, which are devices that consume high amounts of electricity, constitute a significant part of the overall electricity consumption.

Traditional banking electricity consumption sources:

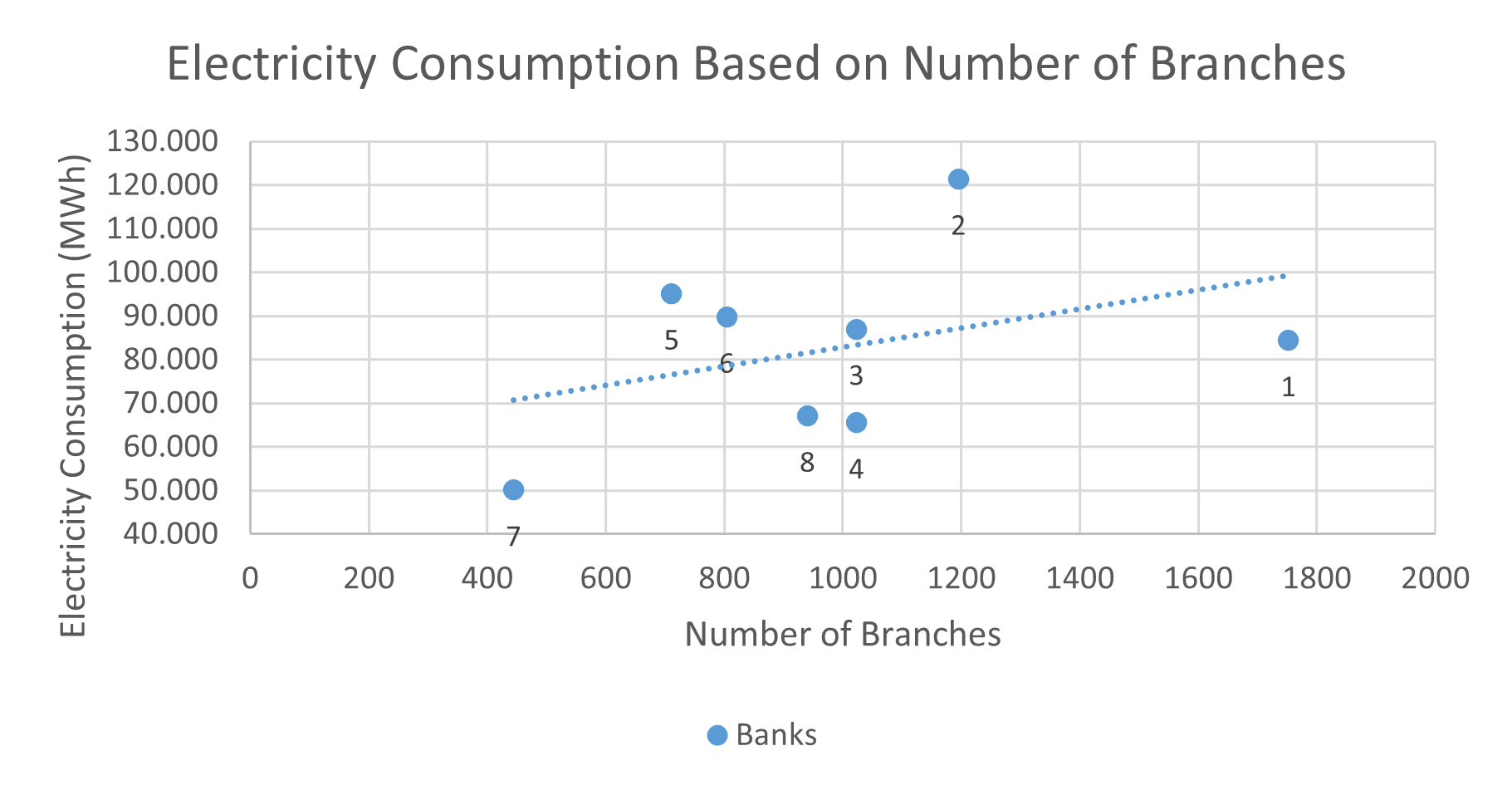

Traditional banking electricity consumption sources include data centers and bank branches. ATM’s, which do not belong to the bank's legal entity, have been excluded from the calculations. The graph below compares the electricity consumption and branch numbers of 8 banks that published sustainability reports in Turkey in 2021. Different results were observed in the increase of annual electricity consumption depending on the number of branches. This is because banks' data centers are also included in electricity consumption.

Figure 3: Shows the electricity consumption of banks according to their branch numbers [4] [5].

Data Centers: A bank's data center operates 24/7, 365 days a year, for a total of 8,760 hours per year. The electricity consumption values of the Credit Bureau's, Kredi Kayıt Birliği (KKB) data center in Ankara [6] and banks in Turkey were compared, taking into account the data center's efficiency and the bank's customer size, and it was estimated that the electricity consumption of banks operating in Turkey comes from their data centers, in the rate of 20,000-40,000 MWh [6]. This average value may vary depending on the bank's asset size.

Bank Branches: Based on the data center consumption calculation method which is mentioned above, the average electricity consumption of bank headquarters and branches in Turkey was calculated as 5000 kWh/month, according to the branch numbers and electricity consumption data in Figure 3. According to data from the Turkish Banks Association (TBB), the average number of branches of the top 10 banks in Turkey is 1000 [4]. Therefore, the annual electricity consumption of a bank's headquarters and branches is estimated to be an average of 60,000 MWh.

The consumption of Turkey's top eight banks is equivalent to Istanbul's six-day electricity consumption [5][7] with an annual average of 0.66 TWh [5]. These consumption rates provide a valuable area for sustainability activities in the finance sector.

Sectors with high consumption rates also offer significant opportunities for energy savings and efficiency improvements. Sustainability activities to reduce Scope 1 and Scope 2 emissions are necessary both to reduce environmental impacts and for the company to save money.

Renewable energy supply methods:

- Banks can invest in renewable energy such as rooftop and ground-mounted solar power plants directly at their headquarters, branches, or other locations.

- Long-term purchase agreements can be made with renewable energy power plants owned by other legal entities, and this can be proven with renewable energy certificates.

- The source of the electricity consumed can be proven directly through spot renewable energy certificates.

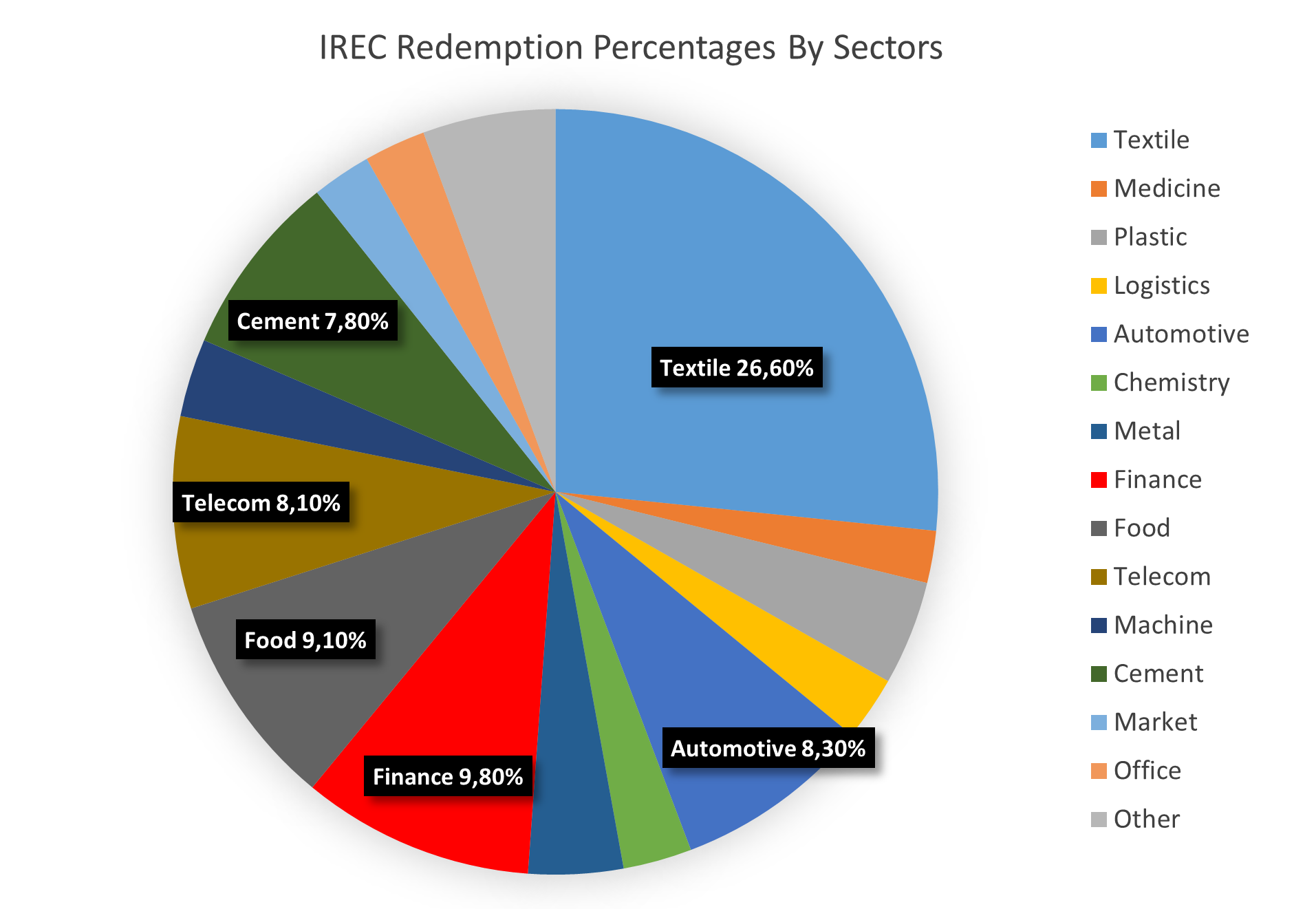

As seen in the following graph, the finance sector is the second sector with the highest number of I-REC redemption in Turkey, with a rate of 9.8% [4]. According to the data for 2021 and 2022, 4 different banks in Turkey redeemed total of 308,188 I-REC certificates. These data only show the certification processes carried out on the Foton Platform and for more detailed information, you can visit the Foton Platform website.

Figure 4: Percentages of IREC certification creation by sector [8].

Usecase : Ziraat Bank

Ziraat Bank, aiming to reduce its carbon footprint due to electricity consumption and to contribute to a sustainable future, and promote the use of renewable energy, has documented with the International REC Standard that the 50,000 MWh consumption of its headquarters, affiliates, and branches is supplied from renewable energy sources. By sourcing its electricity from renewable sources, Ziraat Bank has taken an important step toward the green energy transition for national and international markets.

"Original text has been translated with ChatGPT."

REFERENCE

[1] Tridos Bank, «Triodos Bank Greenhouse Gas,» 2021.

[2] Ziraat Bankası,Yapı Kredi, İşbank, Halkbank, «Ziraat Bankası,Yapı Kredi, İşbank, Halkbank CDP/Sürüdürülebilirlik/Entegre Faaliyet Raporu 2021,»

[4] TBB, «Aktif Büyüklüklerine Göre Banka Sıralaması,»

[5] Ziraat Bankası, İşbank , Garanti Bankası, Halkbank, Akbank, Yapıkredi, QNB Finansbank ve Vakıflar bankası, «2021 Sürdürülebilirlik raporları, CDP ya da entegre faaliyet raporları»

[6] F. G. Ü. Tayyar Can Ünver, «Life cycle assessment-based environmental impact analysis of a tier 4 data center: A case study in Turkey,» Springer, 2023.

[7] EPİAŞ, «Yüzdesel Tüketim Bilgileri,»

[8] Foton Platform, «IREC Platform ve Sertifika Oluşturma İşlemleri,»